Expert Advice: Bagley Risk Management Strategies

Expert Advice: Bagley Risk Management Strategies

Blog Article

Exactly How Animals Threat Protection (LRP) Insurance Coverage Can Safeguard Your Livestock Investment

In the world of animals investments, mitigating threats is extremely important to making certain monetary security and development. Livestock Threat Security (LRP) insurance policy stands as a trusted shield versus the unforeseeable nature of the market, offering a strategic strategy to guarding your properties. By diving right into the details of LRP insurance and its multifaceted benefits, livestock manufacturers can fortify their investments with a layer of safety that goes beyond market fluctuations. As we check out the world of LRP insurance, its role in protecting livestock financial investments becomes progressively evident, guaranteeing a course towards lasting financial resilience in an unpredictable industry.

Understanding Animals Danger Defense (LRP) Insurance Coverage

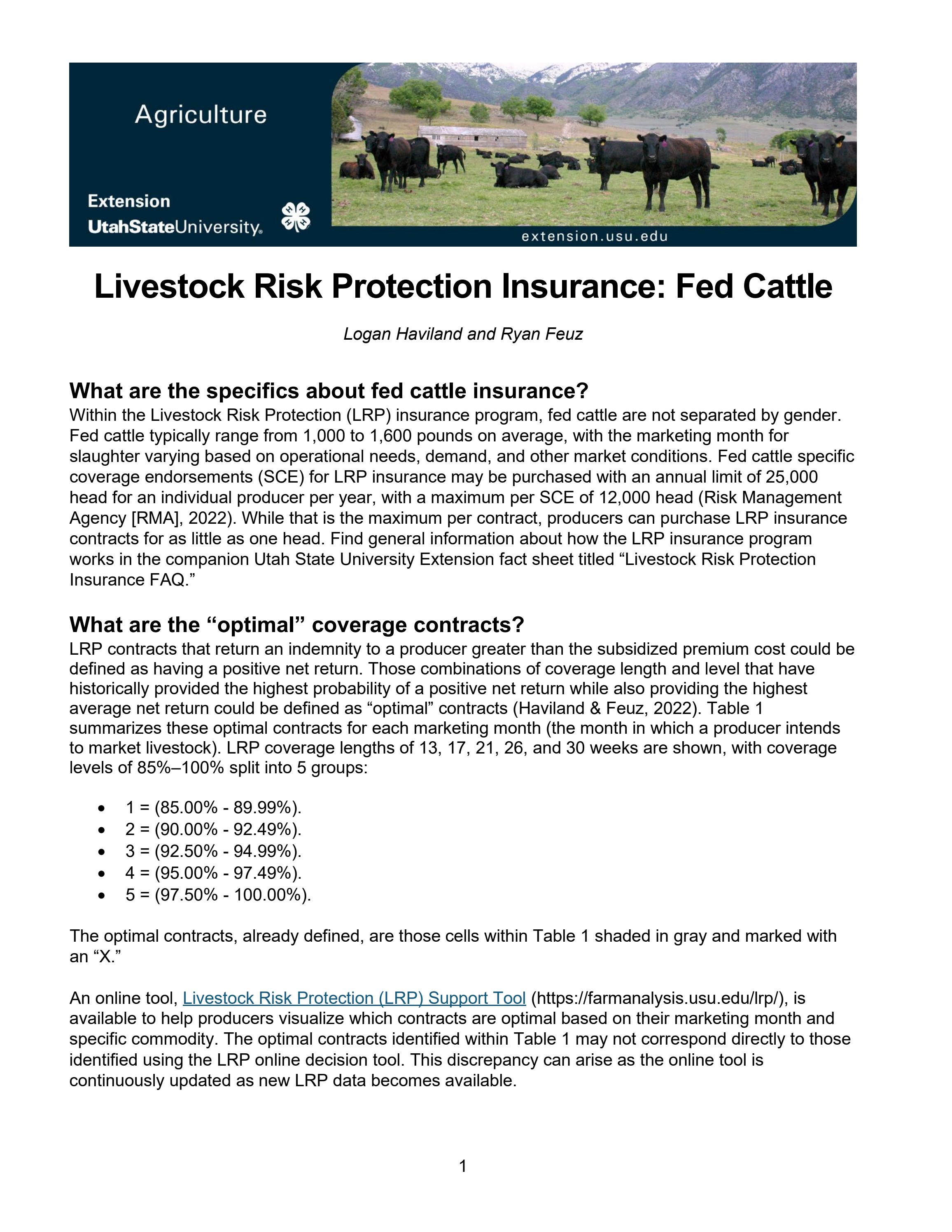

Comprehending Livestock Threat Security (LRP) Insurance coverage is crucial for animals manufacturers looking to minimize financial threats connected with cost changes. LRP is a federally subsidized insurance policy item designed to secure manufacturers versus a decrease in market value. By giving coverage for market price decreases, LRP helps producers secure in a floor rate for their livestock, making certain a minimum level of earnings despite market variations.

One key element of LRP is its adaptability, allowing manufacturers to personalize coverage levels and plan lengths to suit their particular requirements. Producers can choose the number of head, weight range, coverage price, and coverage duration that straighten with their production goals and risk resistance. Recognizing these personalized choices is essential for manufacturers to successfully manage their price danger direct exposure.

Additionally, LRP is offered for different animals kinds, including cattle, swine, and lamb, making it a flexible danger management device for livestock producers across different markets. Bagley Risk Management. By acquainting themselves with the intricacies of LRP, producers can make educated decisions to safeguard their financial investments and guarantee economic security when faced with market uncertainties

Advantages of LRP Insurance Coverage for Livestock Producers

Animals producers leveraging Animals Threat Protection (LRP) Insurance policy acquire a tactical benefit in shielding their financial investments from price volatility and securing a stable financial footing among market unpredictabilities. By establishing a floor on the cost of their livestock, producers can minimize the risk of substantial economic losses in the event of market downturns.

Moreover, LRP Insurance policy provides producers with satisfaction. Knowing that their financial investments are safeguarded against unexpected market adjustments allows producers to focus on other facets of their business, such as boosting animal wellness and welfare or maximizing manufacturing processes. This satisfaction can bring about enhanced productivity and success over time, as manufacturers can operate with more confidence and security. Generally, the benefits of LRP Insurance policy for animals manufacturers are significant, offering a valuable device for handling danger and guaranteeing economic safety in an unpredictable market setting.

Just How LRP Insurance Mitigates Market Risks

Reducing market dangers, Livestock Threat Protection (LRP) Insurance offers livestock producers with a trustworthy shield versus rate volatility and financial uncertainties. By using security versus unforeseen cost decreases, LRP Insurance coverage aids manufacturers protect their financial investments and preserve economic stability in the face of market variations. This sort of insurance coverage allows livestock manufacturers to secure in a price for their animals at the beginning of the policy duration, guaranteeing a minimum rate level despite market modifications.

Actions to Protect Your Livestock Investment With LRP

In the realm of farming threat administration, applying Livestock Threat Defense (LRP) Insurance coverage involves a critical process to safeguard financial investments against market changes and uncertainties. To safeguard your livestock financial investment efficiently with LRP, the first step is to analyze the particular risks your procedure encounters, such as price volatility or unforeseen weather occasions. Next, it is essential to research and pick a trusted insurance policy provider that uses LRP plans customized to your animals and service requirements.

Long-Term Financial Safety With LRP Insurance Policy

Guaranteeing sustaining financial stability with the utilization of Livestock Threat Protection (LRP) Insurance is a prudent lasting strategy for agricultural producers. By incorporating LRP Insurance coverage right into their danger administration plans, farmers my blog can secure their livestock investments versus unanticipated market fluctuations and unfavorable events that could endanger their financial wellness in time.

One secret benefit of LRP Insurance coverage for long-term monetary safety and security is the tranquility of mind it provides. With a reliable insurance coverage in place, farmers can alleviate the economic risks related to unpredictable market conditions and unexpected losses because of aspects such as illness episodes or natural calamities - Bagley Risk Management. This security enables manufacturers to focus on the daily operations of their livestock company without continuous fret about possible monetary setbacks

Moreover, LRP Insurance supplies an organized strategy to managing risk over the long-term. By establishing certain protection degrees and selecting ideal endorsement periods, farmers can customize their insurance intends to have a peek at these guys align with their economic goals and risk tolerance, ensuring a safe and secure and lasting future for their livestock procedures. In final thought, investing in LRP Insurance is a positive approach for agricultural producers to attain long-term monetary safety and security and shield their incomes.

Verdict

To conclude, Animals Threat Security (LRP) Insurance coverage is a valuable tool for animals producers to mitigate market threats and protect their financial investments. By recognizing the advantages of LRP insurance and taking actions to apply it, producers can achieve long-lasting financial safety for their procedures. LRP insurance supplies a safety internet versus cost fluctuations and ensures a degree of security in an uncertain market atmosphere. It is a wise selection for guarding animals investments.

Report this page